Not enough Income to Cover Essential Outgoings?

If you have more money going out than you have coming in, you need to get support from a free professional money adviser to help you improve the financial wellbeing for you and your family.

It is not advisable that you try to deal with your debts yourself.

A money adviser can support you to look at you budget and will assist you to see if you can increase your income or decrease your outgoings. They will advise you on what options you have to deal with your debts. For example, you may need to declare yourself bankrupt so that you can clear your debts and be able to move on. See the support links above from OPFS other organisations that can help you.

There are different options you must deal with your debt depending on your circumstances and how much surplus income you have.

To find out what might be the best option take a look at the three options below to see which match your circumstances.

Not enough Income to Cover Essential Outgoings

You need to decide if you can afford to offer any of your creditors a payment.

If you have more money going out than you have coming in, you need to get support from a free professional money adviser to help you improve the financial wellbeing for you and your family.

It is not advisable that you try to deal with your debts yourself.

No Surplus Income after essential outgoings are paid

Once you have used our Budgeting tool you need to decide if you can afford to offer any of your creditors a payment. Any payments you make will depend on how much you have to offer, how much your total debt is and what debt repayment option is best for you. If you have priority debt such as Rent arrears or there is pending court action it would be in your best interest to get the support of a free professional adviser.

Your credit rating will probably be affected, and it could be difficult for you to get credit in the future.

If after assessing how much you have left over after your essential outgoings have been paid, you have nothing left to offer creditors you will need to carefully consider your options.

You could write to your creditors and ask them to put your debt on hold until you think your circumstances will improve. This is called a moratorium. It is only a short-term solution, and your creditors will not hold off indefinitely.

You could also offer a token payment for example a £1.00 per month for a short period of time, you would need to look at your budget to assess wither you can afford this. This would give you a short period of time to look at more long-term solutions.

Some Surplus Income after essential outgoings have been paid

Once you have used our Budgeting tool you need to decide if you can afford to offer any of your creditors a payment. Any payments you make will depend on how much you have to offer, how much your total debt is and what debt repayment option is best for you. If you have priority debt such as Rent arrears or there is pending court action it would be in your best interest to get the support of a free professional adviser.

Your credit rating will probably be affected, and it could be difficult for you to get credit in the future.

If you decide that you want to contact your creditors and make them an offer you can afford, click on this link to take you through the self-help debt guide.

Contacting your creditors and how much to offer them

Once you know how much you owe each of your creditors, your need to decide how much you can afford to offer them. Look at your completed Budget and Debt List which will show you what you can afford.

Arrange payments yourself

To arrange payments yourself you will need to decide how much you can offer. Be realistic don’t offer an amount unless you can afford to keep to these payments. Better to offer a smaller amount that you know you can afford rather than offering a larger amount that you will then default on the first time you are a bit short of money. Any priority debt repayments usually must cover ongoing charges and add something for the arrears so keep this in mind.

You can offer creditors the same amount each if you owe similar amounts but if your creditors are owed very different amounts, you would be best to split your surplus income between them on a pro-rata basis (whoever is owed the most gets the biggest share of the surplus amount). You will see all your debt details on the debt tool screen which you can change as you need to. Once you have these figures you would write to all the creditors with a list of the offer being made. If a creditor is still charging interest, you would ask again that all charges be stopped so that you can repay your debt as soon as possible.

Arranging deductions through your benefits

You could also look at arranging deductions through your benefits for priority debts for example a set deduction for Council Tax arrears through your Universal Credit, if you arrange this remember to change the details on the income and expenditure pages. These deductions are a good way to spread your payment at a rate you can afford and usually stop your creditor acting against you while you maintain your payments.

It can take weeks for creditors to reply to you and some don’t reply at all but will accept your offer. If you have let the creditor know that they have 28 days to accept or you will take it that they agreed, after this time has passed you can go on and set up your payments.

Third Party Deductions

If you owe arrears for certain things, you can arrange deductions from your benefit. These deductions are called Third Party Deductions. You can usually arrange these yourself or the people you owe the money can apply for these deductions as well.

You can’t have more than three payments deducted and you would need to agreed to having more than 25% of your Personal Allowance taken.

Getting deductions from your benefit to pay arrears can help you budget better as you know exactly how much is being taken and will also have a record of your payments.

Below is a list of the types of arrears that can be deducted:

- Housing Costs (not previous addresses)

- Fuel Costs ( Current provider only )

- Council Tax

- Unpaid Fines

- Water & Sewage Rates.

Below is a list of Benefits than can have deductions taken from them:

- Universal Credit

- Income Support

- Pension Credit

- Job Seekers Allowance

- Employment Support Allowance.

Work out how much to pay each creditor

You can offer creditors the same amount each if you owe similar amounts but if your creditors are owed very different amounts, you would be best to split your surplus income between them on a pro-rata basis (whoever is owed the most gets the biggest share of the surplus amount).

Example

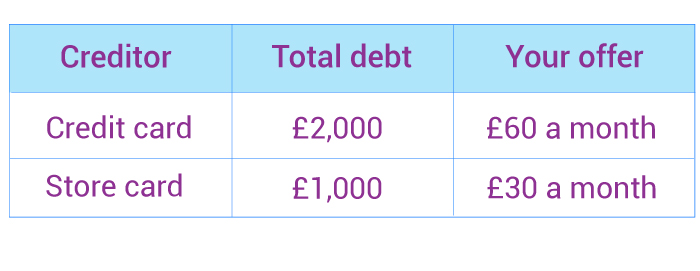

You’ve got 2 debts

You owe money on a credit card and a store card.

How much do you owe on each?

You owe twice as much on the credit card as you do on the store card, so your offer to the credit card company should be twice as much.

What have you got left?

You have £90 left each month to pay off your debts.

Write to your creditors

Write to each creditor with your repayment offer and include a copy of your budget. This will show creditors you’re only spending money on essential living costs and that the offer you’re making is fair.

Make sure you explain how much you can afford to pay each week or month.